What is VSI Insurance?

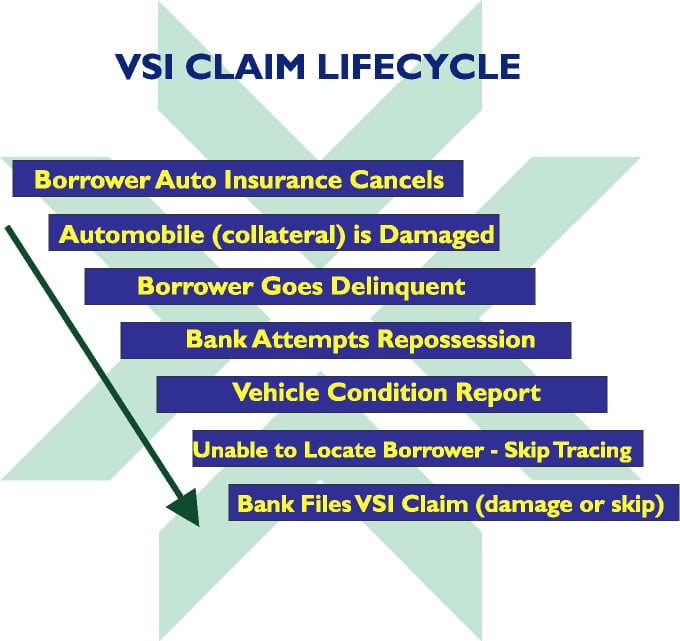

VSI Insurance is an insurance program for lenders that transfers collateral risk from their vehicle portfolios. VSI insurance premium is collected as part of the loan origination process and protects the lender from uninsured physical damage to the vehicle. The vehicle loan must be in default to file a VSI Insurance claim, and the lender must either repossess or be unable to locate the collateral.

Vendor Single Interest is the “VSI” in VSI insurance. LSI Insurance, or Lender Single Interest Insurance, is a synonym. “Single Interest” defines a policy that protects the interest of the lender only. The VSI claim payment will reduce the borrowers’ charge-off balance. The borrowers benefit as their unpaid loan balance is reduced and sometimes eliminated. Therefore, VSI Insurance does not entirely meet the definition of “Single Interest”.

Features & Benefits of VSI Insurance

When a lender makes a vehicle loan, the loan decision is evaluated based on:

- the borrower’s creditworthiness

- and the value of the vehicle.

The lender assumes the credit risk of the borrower but may choose to transfer the collateral risk. VSI Insurance protects the value of the vehicle during the life of the loan. The borrower is contractually obligated to maintain physical damage insurance on the vehicle, but there is a small percentage of uninsured borrowers that create collateral risk for the lender.

The Insurance Research Council’s 2015 study shows that only 13 percent of US drivers are uninsured. In addition to this, 18 years of Miniter Group’s VSI Insurance loss data shows that when borrowers’ FICO credit re-scores dip below 680, there is a positive correlation between these lower re-scores and uninsured VSI claims.

A prime lender may originate loans with an average FICO credit score well above 700. However, our data shows that a significant number of borrowers may re-score well below 680 in a recession, many of which are in the sub-prime range.

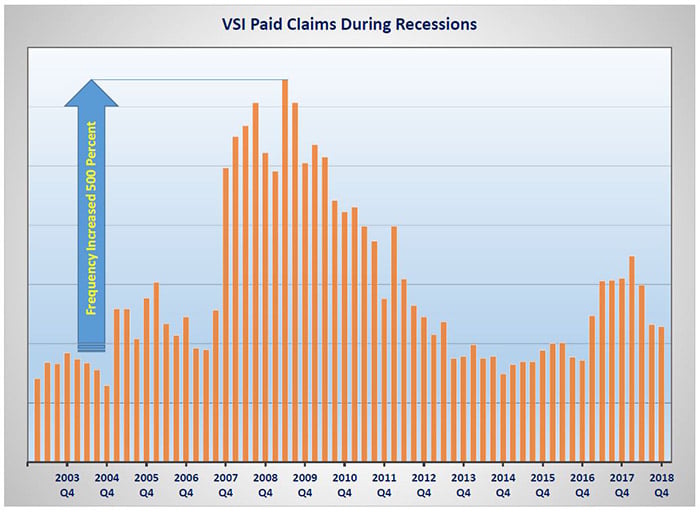

Borrower vehicle insurance may lapse due to lost employment or other economic issues that are related to the recession. If an uninsured borrower gets into an accident, his or her loans will go delinquent, and the lender will repossess the damaged collateral. Therefore, uninsured borrowers cause VSI Insurance claims to spike during a recession.

In 2015 Miniter Group began to observe a shift in the VSI Insurance loss profile between damage and skip claims. Miniter Group’s “The Changing Landscape of Vehicle Portfolio Insurance” details how VSI Insurance skip claim losses now exceed damage claim losses.

VSI Insurance History

VSI Insurance as we know it today is different from its origins as a dealer-based product that was sold to transfer risk from the dealer. VSI history goes back to May 1968 with the first revision of the Truth In Lending Act (TILA). The subsection describing the VSI disclosure has remained in TILA, word for word, since that time.

During the late 1970s, the National Installment Agency operating in Maryland began selling a VSI Insurance policy to lenders underwritten by Fidelity & Deposit Insurance Company. This policy was paid for by the lender, which included similar coverages as today’s policy.

The current VSI Insurance policy, which is paid by the borrower at loan origination, came into existence due to the 1980-82 US recession. During that recession, interest rates peaked over 20 percent.

The lending industry wanted to revitalize vehicle lending after record delinquencies and charge-offs. VSI Insurance was considered to be a viable solution for transferring collateral risk. TILA regulation defined disclosures regarding premiums for insurance, and this allowed lenders to charge the VSI Insurance premium to the borrower at loan origination. Passing the VSI charge to the borrower and the ability to exclude the VSI premium from the APR calculation have created the current form of the program.

VSI Insurance today continues to remain popular in specific geographic regions based on the original work of retail brokers in the 1980s. These brokers included Arthur Donley (Miniter Group) in New England, Paul Boardway in New York, Larry Hartman in the Mid-Atlantic, and Stan Funderburg in Oklahoma and Kansas.

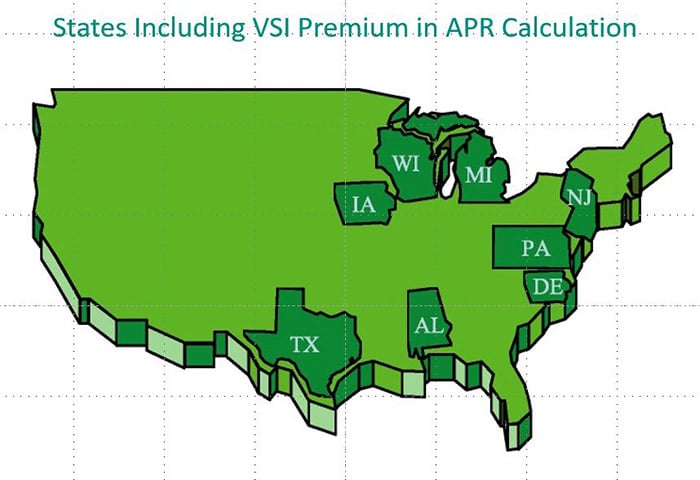

These brokers influenced state regulation to follow federal law (TILA) and exclude VSI Insurance premium from the APR calculation. There is a common misconception in the industry that VSI Insurance is illegal in many states. VSI is not popular in eight states because the APR calculation must include VSI premiums. However, VSI Insurance is legal across the USA, and forty-two states allow the APR exclusion for VSI premium.

In the late 1990s, VSI Insurance underwriters entered the market and attempted to change the traditional VSI program. Smaller insurance companies with limited reserves created what is known today as VSI Cap Programs, which limited the loss exposure to insurance companies. Initially, the reason for VSI Cap programs was to limit loss exposure to sub-prime vehicle portfolios, but underwriters introduced this concept to some large prime portfolio lenders.

In 1999, the courts weighed in on these CAP programs where the insurance company would never be obligated to pay claims above the amount of premium received. In the 7th Circuit Court of Appeals case ADAMS v PLAZA FINANCE COMPANY, INC., the plaintiff successfully argued that VSI Cap policies are financial arrangements and not insurance.

A financial arrangement fee is not a premium, so the court agreed that this fee must be part of the APR calculation. Lenders with VSI Cap policies were initially unaware of this ruling, but this practice came to an end in 2012 when the CFPB began auditing larger indirect lenders.

Since the early 1980s, VSI Insurance has successfully transferred vehicle collateral risk. VSI Insurance has passed the scrutiny of the CFPB and other regulators in addition to a recent legal challenge by a consumer attorney in the 2015 case PAGE v BB&T. Today, VSI Insurance is used by large, indirect lenders as well as smaller banks and credit unions to transfer collateral risk for the life of their vehicle loans.

The VSI Insurance Policy

There are four coverages associated with VSI Insurance. The two significant coverages, physical damage and skip, depend on the success of the lender’s repossession efforts. If the condition report of a repossessed vehicle shows physical damage, the lender files a VSI physical damage claim. If the lender’s repossession attempts are unsuccessful, then the lender will file a VSI Insurance skip claim.

Additional endorsements are available but not covered in this article.

1. Physical Damage and Theft

All Risk Physical Damage protects the lender against losses due to uninsured and damaged repossessed vehicles

2. Skip & Confiscation

Protects the lender against loss due to the inability to locate the collateral or any borrower or co-borrower when a public office prevents the lender from recovering collateral.

3. Instrument Non-Filing

Provides coverage if a public authority prevents the lender from repossessing the vehicle or retaining the proceeds because the lender has not recorded its lien or the state registry has not shown the named insured’s interest.

4. Repossessed Vehicle Coverage

Provides All Risk Physical Damage coverage to damage losses that occur after repossession of the vehicle for a period of 90 days.

Broad form skip coverage is an enhancement to the VSI policy that specifies recovery of the vehicle within 90 days or a VSI skip claim payment will be processed. Standard skip coverage specifies the location of the borrower or vehicle within the 90-day window.

VSI Insurance Underwriting

The typical prime vehicle portfolio will see approximately 50 basis points charge-off in a good economy and up to 300 basis points in a recession. If we use the example of a 100 basis point repossession rate, with a claims frequency of 25 percent and an average VSI claims payment of $6,500, the math shows that collateral risk in this example is $16.25 per loan. Using this example, you can plug in your portfolio’s numbers to estimate your collateral risk.

As stated above, we have observed that the portfolio collateral risk can change by a factor of six from an excellent economy to a recession. In a recession, the challenge for lenders using VSI Insurance is to maintain VSI premium rate stability when the portfolio FICO re-score degrades, and more borrowers are uninsured. Miniter Group uses actuarial analysis to help lenders maintain rate stability in both good and bad economies.

Since 2002, Miniter Group has collected data for actuarial analysis of dozens of large vehicle portfolios. We have studied over 80 million loan records during this time. The analysis uses origination FICO scores, and periodic FICO re-scores along with loan duration, repossession and charge-off history. The actuarial model will accurately trend the collateral risk of a portfolio on a per loan basis in much greater detail than the previous underwriting example.

Two VSI Insurance policies are popular in the industry. A “claims-made” policy is a policy that works similar to a standard vehicle insurance policy. There is also a “life-of-loan” policy that provides VSI Insurance coverage beyond the VSI policy period.

Smaller vehicle lenders typically use the “claims-made” policy that provides the coverage described above during the VSI policy period. This policy type uses effective, and expiration dates to determine the eligibility of claims payments. The claims-made policy covers a lender’s portfolio from the effective date, which provides the full benefit of reducing net charge-offs to the lender during the policy term.

The “life-of-loan” policy is used by larger indirect lenders to provide VSI Insurance coverage for the duration of the loan regardless of whether the VSI policy is in effect. The advantage of the life-of-loan coverage is that loan portfolios will have guaranteed collateral risk transfer, which may enhance pricing for securitized portfolios.

A lender’s portfolio size and individual risk transfer goals, along with expertise from the VSI Insurance broker will determine the best VSI Insurance policy to maximize the collateral risk transfer of the portfolio.

VSI Claims Processing

VSI Insurance administration, as well as claim submission by the lender, is simple and straightforward. During the claims process, the Retail Installment Sale Contract serves as proof of VSI coverage, so there is no requirement for integration to lender servicing systems.

Filing a VSI Insurance Claim

VSI Policy parameters specify the following claims processing requirements:

1. Research the borrower’s primary insurance

Based on the latest insurance information collected from the borrower. Many times the most recent data is the Agreement to Provide document obtained at loan origination.

2. Submit loan documentation

Including retail installment contract, collection notes, repossessed vehicle location, and other documentation if required.

3. Schedule the VSI damage appraisal

A third-party vehicle appraisal company will visit the vehicle and complete a damage appraisal report for the vehicle.

4. Process the Claim Payment

The claim payment processing occurs upon receipt of the damage appraisal.

Manual Processing

Manual processing of VSI Insurance claims will process each of the above items in a sequence, many times taking up to 60 days to complete this process. Automation of these processes will put each of these steps in parallel and reduce the damage claims processing times to under eight days.

Skip claims require the lender to submit the claim within 180 days of delinquency. Once filed, the VSI claims process has 90 days to complete the skip investigation. The outcome depends on the skip coverage policy definition.

- Broad Form Skip – the vehicle must be located and repossessed before 90 days, or the VSI skip payment is processed.

- Standard Skip – the vehicle, the borrower, or the co-borrower must be located before 90 days, or the skip claim payment is processed.

Miniter Group founded Miniter Investigation, Inc. (MI2) in 2002 to align VSI Insurance skip tracing with the goals of the lender. A conflict exists when a VSI provider outsources skip tracing to a third party. The conflict occurs when the lender is unable to repossess the vehicle after the skip agent locates the vehicle. In these scenarios, the Skip tracing company that did their job is expected to be paid. The lender wants the Skip tracing to continue, but an additional fee may be required. By owning MI2, Miniter Group avoids this conflict and will continue to work to recover the vehicle or pay the skip claim.

The VSI Insurance provider may assist the lender in determining the status of the borrowers’ insurance as of the date of repossession. They may also file claims with these carriers as part of the program services, but this is not a requirement of the VSI Insurance policy.

VSI Insurance Compliance

Requirements for VSI Insurance compliance require lenders to manage the following:

TILA Disclosures

The VSI Insurance premium can be charged to the borrower at loan origination as long as the Retail Installment Sales Contract (RISC) uses the proper disclosures as defined in TILA. This disclosure states that the lender requires VSI Insurance, but the borrower may obtain coverage elsewhere. Also, but not shown in the disclosure, the VSI Insurance company may not subrogate against the borrower.

Below is a typical VSI Insurance disclosure for a RISC:

APR Calculations

There are currently eight states that have laws that include VSI Premium in the APR calculation. All other states exclude VSI premiums from the APR calculation on the Retail Installment Contract.

Full Risk Transfer

As discussed earlier, there is case law that concluded VSI Premium could only be excluded from the APR if the VSI Insurance policy is a full risk transfer policy. The court’s opinion stated that if the policy is not a full risk transfer policy, then the VSI is considered to be a “financial arrangement” between the insurance company and the lender, and the APR must include this charge. VSI Cap programs that limit the liability to the insurance company are considered financial arrangements.

Skip Tracing Procedures

Third-party skip tracing procedures used by the VSI Insurance provider must comply with Sections 804-808 of the Fair Debt Collections Practices Act. Review these procedures with your VSI Insurance provider and conduct periodic audits of these procedures as part of your Vendor Management audits.

VSI Disclosure – Retail Installment Sale Contract

“VENDOR’S SINGLE INTEREST INSURANCE (VSI insurance): If the preceding box is checked, the Creditor requires VSI Insurance for the initial term of the contract to protect the Creditor for loss or damage to the vehicle (collision, fire, theft). VSI Insurance is for the Creditor’s sole protection. This insurance does not protect your interest in the vehicle. You may choose the insurance company through which the VSI Insurance is obtained. If you elect to purchase VSI insurance through the Creditor, the cost of this insurance is $______ and is also shown in Itemization of Amount Financed. The coverage is for the initial term of the contract.”

Vendor Management

The current FDIC Compliance Examination Manual has 104 questions regarding vendor management. Any regulator will view VSI Insurance as a 3rd party relationship that houses borrower’s sensitive data.

Since Social Security Numbers (SSN), Date of Birth (DOB), and account numbers are part of the information transmitted during the VSI Claims process, regulators will examine your VSI Insurance outsource relationship as a critical vendor.

Miniter Group has led the way in our industry, publishing multiple Vendor Management Articles as well as periodic webinars regarding Vendor Management.

For additional information regarding vehicle portfolio protection, please review “Miniter Group’s Complete Guide to Force-Placed Insurance”.

Please feel free to reach out anytime and Ask Us Anything.

Curious about our range of solutions for vendor single interest insurance? Take a look at these insightful articles:

Understanding VSI Insurance in a Recession

A Detailed Review of VSI Insurance vs CPI Insurance