Introduction

Skip losses that occur as part of a lender’s vehicle portfolio have made a significant increase since 2014 and now represent over 50% of all vehicle losses. Vendor Single Interest Insurance (VSI) is becoming increasingly popular with lenders due to the change in loss profile.

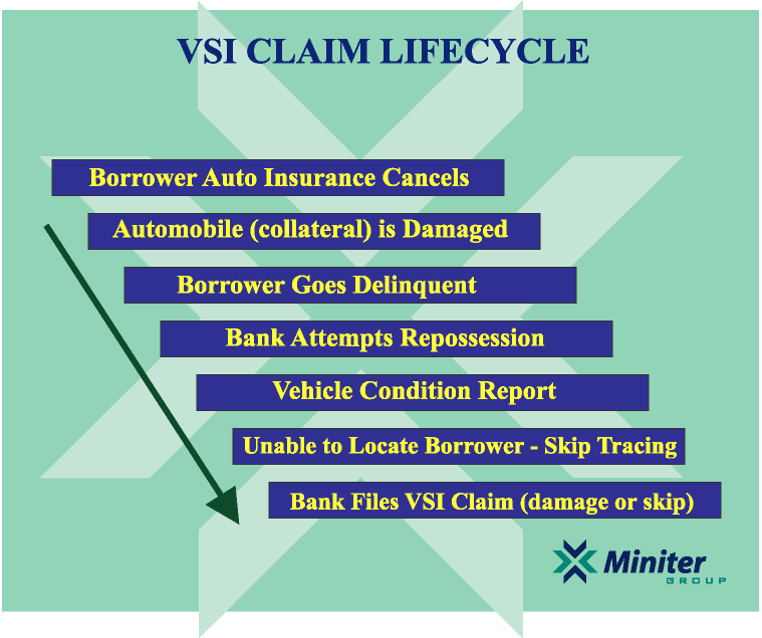

Portfolio losses from skip coverage occur when a borrower is delinquent on payments, and the lender attempts to repossess the collateral. The borrower knows the vehicle is about to be repossessed and attempts to hide the vehicle in order to avoid repossession.

Since 1997, Miniter Group, the largest blanket Lender Single Interest Insurance provider in the US, has collected data on 109,000 VSI claims totaling $214 million.

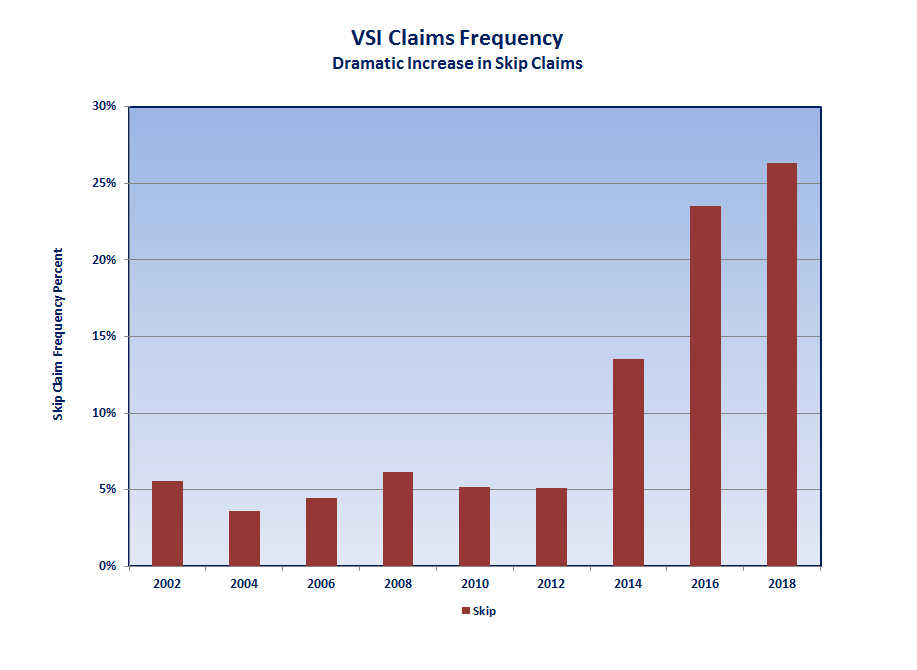

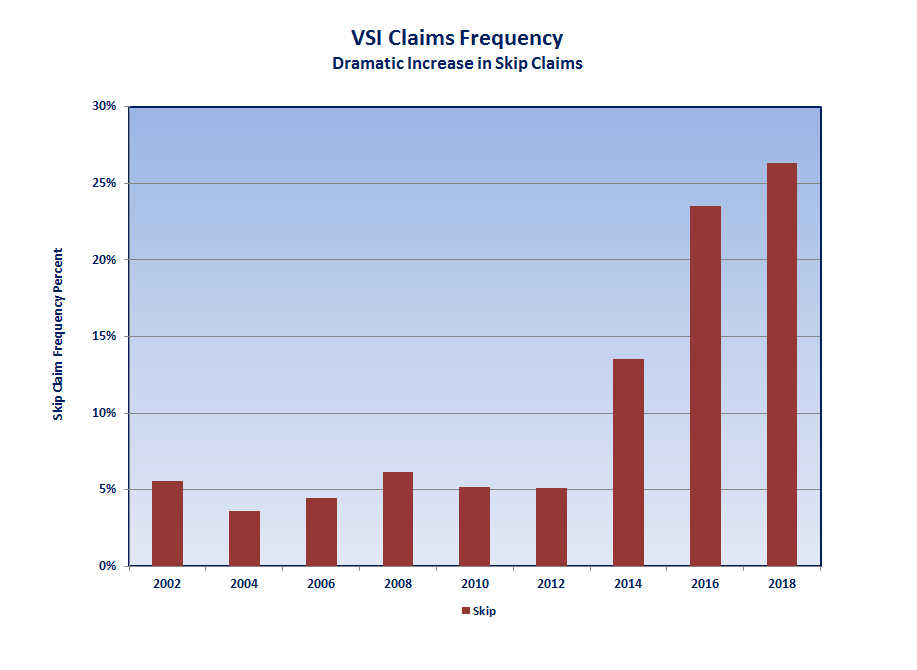

Prior to 2014, physical damage losses in a lender’s portfolio accounted for 90.5% of collateral losses, while skip losses represented 9.5%. However, skip claims payments now represent 53% of total VSI Insurance payments, which is a 550% increase since 2015.

This article will discuss the effects of this change and why VSI Insurance should be looked at for vehicle collateral risk transfer.

Skip Loss History

In 2014, Miniter Group began to observe significant increases in both the frequency and severity of skip claims. Since 2002, skip claims have increased over 20%, and the average skip claim payment increased more than $4,000 from 2014 to 2016.

For lenders using Vendor Single Interest Insurance, total skip claims payments have exceeded damage payments since 2016.

Miniter Group has been talking with many banks and credit unions, including two top US lenders, regarding this phenomenon. Lenders have no quantitative answers to this change in risk.

In discussing this phenomenon with Miniter Investigations, Inc. veteran skip tracers, they believe that certain borrowers have developed an entitled attitude towards lenders. Voluntary repossession has decreased as this entitlement mentality justifies borrowers hiding their vehicles rather than cooperating with a voluntary repossession.

This trend is expected to continue. Lenders should investigate VSI Insurance as a way to mitigate skip risk on their vehicle portfolios.

Blanket Single Interest vs Collateral Protection Insurance

Insurance policies for transferring collateral risk include Collateral Protection Insurance (CPI), which is a track and force-place insurance program, and the previously mentioned blanket program known as Vendor Single Interest (VSI).

Although completely different in their delivery systems and results, both CPI and VSI transfer all the physical damage risk from a lender’s vehicle portfolio. However, CPI insurance has limited skip coverage which must be paid for by the lender.

Collateral Protection Insurance (CPI) premium is charged to the borrower upon the lapse of the borrower’s own insurance. This premium, which is paid by the borrower cannot include skip coverage as part of the premium. A compliant CPI program must have the lender pay for the skip coverage separate from the premium that the borrower is charged.

In the 1997 Model Act, created by the National Association of Insurance Commissioners (NAIC), skip coverage is forbidden in the coverage associated with borrower force-placement. Since that time, CPI programs have used a “Rob Peter to Pay Paul” approach to skip coverage by charging the lender a small premium to pay skip losses. The skip losses are usually well in excess of the premium collected.

This insurance company accounts for the excess skip losses by taking excess premium out of the borrower’s force-placed premium pool and using this to fund the lender’s skip coverage premium pool. It is Miniter Group’s opinion that this methodology for funding CPI skip coverage is on a slippery compliance slope.

Vendor Single Interest differs from CPI in how it addresses skips. Skip coverage has been an integral part of the value proposition of the VSI program since its inception in the 1980s. The borrower pays for both physical damage and skip coverage with a small premium that is charged at loan origination. This charge is excluded from the APR in most states. Lender collection departments file skip claims when vehicle repossession is unsuccessful.

The VSI provider is responsible for skip tracing. Miniter Group uses our in house skip tracing unit for locating and repossessing the vehicle. If they are unable to locate and repossess the vehicle within 90 days a VSI skip claim payment is processed for either the loan balance or ACV retail of the vehicle.

Conclusion

There is renewed interest in the lender marketplace for VSI Insurance due to the increased frequency of skip claims over the last 4 years. Skip claims have become a significant part of auto portfolio charge offs and lenders are looking for programs to transfer this risk.

The hurdle that remains for VSI insurance to gain national appeal is to change loan contracts at both DealerTrack and RouteOne to include the TILA required VSI disclosure.

Contracts must include the Regulation Z (TILA) VSI disclosure in order for lenders to charge for VSI at loan origination. Once this has been accomplished, national lenders will be able to begin to transfer their increasing skip risk.

For more information about VSI Insurance, please review “Miniter’s Complete Guide to VSI Insurance”

Please feel free to reach out anytime and Ask Us Anything.