What Is Force-Placed Insurance?

Force-placed insurance is commonly used by most lenders to transfer property risk associated with Commercial, Residential, or Vehicle loans. Force-placed insurance has many names, such as

- Lender-Placed Insurance,

- Creditor-Placed Insurance,

- or Collateral Protection Insurance.

These names are synonymous with force-placed insurance.

Force-placed insurance has two components:

- Insurance Tracking – The lender monitors the borrower’s insurance policy per the requirements of the loan contract.

- Lender-Placed Insurance – The lender has a certificate of insurance issued to protect the value of the collateral securing a specific loan. This certificate becomes effective if insurance tracking discovers the borrower’s policy has lapsed or is insufficient based on the loan contract.

Features & Benefits of Force-Placed Insurance

When a lender makes a Commercial, Residential, or Vehicle loan, the loan underwriting decision takes into account:

- the creditworthiness of the borrower,

- as well as the value of the property.

The lender assumes the credit risk associated with the borrower, but will typically transfer the collateral risk to a force-placed insurance program, which will protect the value of the property for the life of the loan.

The borrower is contractually obligated to maintain insurance to protect the collateral, but a 2016 poll from the Insurance Information Institute shows that five percent of homeowners do not maintain coverage. We would argue that this percentage has risen since COVID-19.

The lender relies on insurance to protect the value of the property securing the loan. Insurance policies cover common perils including fire and vandalism, but wind and flood may not be covered. A lender must monitor the status of these insurance policies that protect the loan’s collateral.

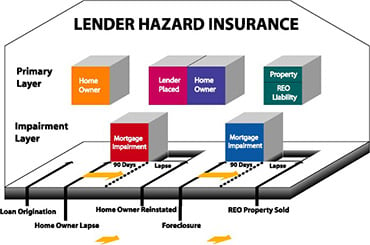

Insurance Policies – There are three types of insurance policies used to protect the lender’s interest. The borrower obtains the primary coverage based on the loan agreement. If the borrower fails to maintain this coverage, the Lender-Placed Insurance policy is used to protect the property for the lender and borrower. A final layer of insurance known as Mortgage Impairment Insurance is available to the lender if a loan default is due to property damage.

Lenders require borrowers to include them as Mortgagee on their primary Insurance policy. Once listed, the lender receives insurance company notifications related to that policy. The lender uses these notifications to track the status of the borrower’s insurance. If the lender discovers a policy lapse or insufficient coverages per the loan documents, the lender will use the Lender-Placed Insurance policy to fill these gaps in coverage.

The History of Force-Placed Insurance

Force-Placed Insurance began in its modern form with the introduction of the PC and mid-range batch processing computers in the mid-1980s. Innovative insurance companies created the “X-Checking” insurance tracking methodology. X-Checking had loan servicing open insurance mail looking for notices of cancellation or non-renewal. This information would be data entered into a PC, and the MS-DOS or IBM AS/400 data file was sent to the insurance tracker weekly via US mail.

Tracking has evolved significantly since then...except for pesky legacy implementation.

Insurance trackers would use these files to force-place insurance on the borrower at the expiration date. Insurance placements, known as Certificates of Insurance, were based on a 12-month Lender-Placed Insurance policy whose premiums could be in the thousands of dollars. The insurance tracker would bill the lender, and the lender would subsequently charge the borrower.

X-checking Insurance Tracking

X-checking tracking typically only looks for cancellation and non-renewal notifications from the borrower’s insurance company. The x-checking insurance tracker did not look for reinstatement documents. Therefore, cancellation of lender-placed insurance and the associated premium refunds took too much time. The insurance tracker held large sums of the insurance premium, and “premium float” became a common income source among insurance trackers. Timely refunds were not a priority unless demanded by the lender.

Lender Fee-Income

From the late 1990s until the 2010 Dodd-Frank Act, large lenders used force-placed insurance as a fee income source. During this timeframe, large lenders were originating loans and securitizing them in the secondary market. A loophole in the Real Estate Settlement Procedures Act (RESPA) law enabled escrowed premiums to be re-directed towards force-placed insurance premiums. Large banks created captive insurance companies to collect underwriting profits from these premiums.

Dodd-Frank Reform

The lobbying effort by the sizeable force-placed insurance companies was largely unsuccessful during the writing of the Dodd-Frank Act. Force-placed insurance is mentioned 330 times in the Act, which directly addressed the issues discussed above.

Dodd-Frank created the Consumer Financial Protection Bureau (CFPB), which re-wrote the RESPA rules updating the current law regulating force-placed insurance for the mortgage industry.

Truth in Lending Act (TILA) regulates force-placed insurance for vehicles as a consumer loan. Force-placed coverage on cars is commonly called Collateral Protection Insurance. Force-Placed Insurance regulation on vehicles has not caught up to the standards of the mortgage industry. The National Association of Insurance Commissioners (NAIC) is currently working on a Lender-Placed Insurance Model Act.

Lender-Placed Insurance Policy Underwriting

The lender-placed insurance policy is a property & casualty master policy that issues certificates of insurance when a borrower is force-placed. The certificate of insurance does not require individual property underwriting, as is the case with a homeowner’s policy. The lender’s entire portfolio is used to determine premium rates for these certificates.

These ratings use the geographic locations and loss history of the lender’s portfolio. Coastal high-risk areas, along with high concentrations of properties may increase premium ratings.

Force-Placed Flood Insurance policies are underwritten based on Special Flood Hazard Areas (SFHA) defined by the FEMA and the NFIP.

Premium rating for these certificates uses the SFHA flood zones, as well as specific state, county, and zip code locations. NFIP premium rating now uses automated algorithms from their Risk Rating 2.0 initiative.

Lender-Placed Insurance premiums are always higher than the borrowers’ primary homeowners or commercial insurance policies. Borrower insurance policies underwriters directly evaluate risks associated with a property, which typically results in lower premiums. In some locations, the lender-placed flood insurance premium may be lower than NFIP flood policies that are purchased by borrowers.

The Legacy Insurance Tracking Business Model

As stated earlier, protecting the value of a loan’s collateral using force-placed insurance involves both the lender-placed policy and insurance tracking. The lender’s loan servicing department is responsible for providing insurance tracking. Internal tracking provides an acceptable borrower experience, but operationally, the cost of this service is expensive.

Some lenders look to outsource insurance tracking to reduce this operational cost. Historically, force-placed insurance tracking has not aligned with the lenders’ goal of providing the best possible borrower experience. The insurance tracking business model is the root cause of unacceptable borrower experiences.

The legacy business model promotes low-cost or no-cost insurance tracking. On the surface, this appeals to the lender looking to reduce operational cost, but the lender must look deeper if borrower satisfaction cannot be compromised.

The legacy business model, used by the majority of the industry, requires lender-placed insurance premium to subsidize below-cost insurance tracking. This legacy model requires insurance trackers to force-place insurance on borrowers. The commissions from lender-placed insurance premium collected from two percent of borrowers pay for the tracking costs of the other ninety-eight percent in the portfolio.

Rather than helping borrowers maintain their cost-effective primary insurance, the legacy model promotes force-placements, which results in unhappy borrowers.

Insurance Tracking Compliance Requirements

Mortgage Hazard

The 2014 Mortgage Servicing Rules for Reg X (RESPA) and Reg Z (TILA) went into effect on January 10, 2014. This rule required significant changes to all aspects of mortgage lending. Force-Placed Insurance was a substantial part of these changes.

These changes are detailed in our “9 Steps to CFPB Compliance for Force-Placed Insurance”.

Flood Insurance

Joint Agencies regulate force-placed flood insurance. Regulatory guidance was a moving target since the Biggert-Waters Act became law on January 2012. This Act was soon modified based on a consumer revolt, and the result was the 2014 Homeowner Flood Insurance Affordability Act.

Both FEMA and the Joint Agencies could not keep up with these congressional changes. Confusing regulatory exams led to lenders disputing flood compliance examinations. The confusion came to an end when the Joint Agencies published their 2015 Final Rule, which went into effect on July 21, 2015. We analyzed the impact of this rule for lenders in our article “Force-Placed Flood Insurance – Joint Agency Final Rule”.

Private Flood Insurance

Private flood insurance took center stage in 2019 as the Joint Agencies defined the requirements for lenders to accept private flood insurance by July 1, 2019.

Collateral Protection Insurance

The National Association of Insurance Commissioners (NAIC) is currently the only pending Force-Placed Insurance regulatory initiative. The current Lender-Placed Insurance Model Act Working Group’s ongoing efforts since 2012 seek to align vehicle Force-Placed Insurance regulation with the mortgage industry.

Vendor Management for Outsourced Insurance Tracking

Any regulator will view an outsource Force-Placed Insurance Company as a 3rd party relationship that houses borrower’s sensitive data. Since loan numbers, date of birth (DOB), and insurance policy numbers are part of the information transmitted during the insurance tracking process, regulators will examine your force-placed insurance outsource relationship as a critical vendor.

Due to the recent scrutiny of force-placed insurance programs at large lenders, including the Wells Fargo Class Action Lawsuit, lenders must be diligent with the vendor management program of their outsource insurance tracking vendor.

Miniter’s Borrower-Centric Insurance Tracking Business Model

In 2006, Miniter Group began writing software for a new type of insurance tracking system that would align with lenders’ goals of providing the best possible borrower experience. We dismissed the legacy insurance tracking models.

Borrower-Centric Insurance TrackingSM

This insurance tracking methodology provides a better experience for borrowers whose insurance has lapsed or is insufficient. The goal of Borrower-CentricSM Insurance Tracking is to stay behind the scenes. We engage your borrower’s broker, not your borrower. We obtain accurate insurance information from their agent to avoid sending force-place notifications to your borrower.

Working with the Borrower’s Insurance Broker

We have found that engaging the borrower’s broker by telephone supported by real-time data acquisition systems works best. This process is time-consuming with average call times in the 4-7 minute range. This process is expensive and cannot be done effectively using a low-cost or no-cost insurance tracking model.

Effectively working with the borrower’s broker, sometimes involving multiple calls and tracking broker commitments is the key to obtaining accurate insurance information and remaining behind the scenes.

Notification Letters

Before sending the required insurance notification letters, we have completed work with the borrower’s broker, which did not resolve the borrower’s insurance discrepancy. The next step is to send notification letters. The CFPB regulates the hazard notification letter content, and the Joint Regulatory Agencies loosely regulate the flood letter content.

Letter sequencing and timing are critical to the Joint Agencies for flood, but CFPB offers flexible timing to begin a letter cycle. Letter notifications can be closely scrutinized during regulatory exams, so understanding the requirements for both is critical to success.

Working with Your Borrower

One to two percent of your borrowers will be force-placed at any point in time. Placement will vary based on economic conditions and will also have a positive correlation to the borrower’s current credit score.

Insurance notification letters generate inbound calls from borrowers. This call is the point where Borrower-CentricSM meets the borrower. To provide the service our lenders expect, we must be at our best during these calls. Our agents are highly trained to handle the most challenging borrower.

The extensive work we have done with their agent before this call allows us to provide insight into their current insurance as well as specific instructions to remedy the situation. Our goal is to provide one-call resolution. Many times, we will reach out to the borrower’s broker after the call to finalize insurance requirements.

Lender-Placed Insurance Premium Billing

A monthly or annual invoice will be provided to the lender electronically on the first of the month. Real-time reconciliation of invoice at the exact point the lender is paying eliminates red-lining of the invoice. Real-time invoicing saves time for both the lender and Miniter.

Please feel free to reach out anytime and Ask Us Anything.