Vendor Single Insurance, also known as VSI Insurance, is designed for lenders who desire to transfer the risk of default on their vehicle originations.

Understanding how this product works alongside other lender protection programs helps financial institutions improve their risk management and analysis as interest rates rise and recession looms.

How Does VSI Insurance Work?

By transferring the collateral risk of vehicle loans, lenders notably deepen their prospective customer pool. While it does not affect borrower risk, it protects them if a loan is in default and a vehicle sustains damage.

A VSI Insurance premium is collected at the time of origination. If a borrower defaults and the vehicle is repossessed with damage, a VSI claim can be filed. Additionally, in the event the vehicle is unlocatable, a VSI claim can be filed.

The lender is able to recoup the value of the vehicle and offset cost of the damages or unrecoverable collateral.

Why Use VSI Insurance?

Note that a borrower is required to maintain physical damage insurance on the vehicle, but the percentage of borrowers who default on their loans and insurance payments rises in a recession.

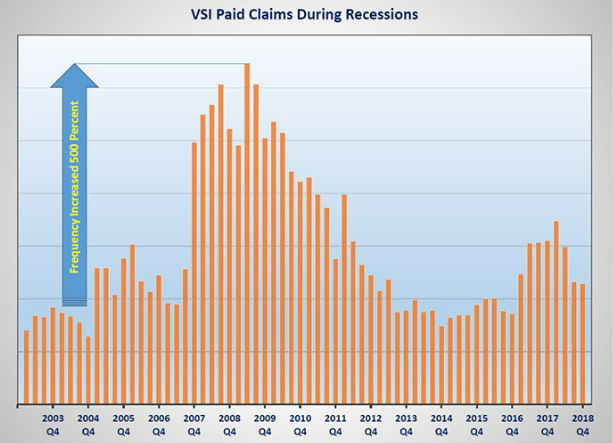

There are a number of reasons why historically, we see that VSI Insurance becomes increasingly valuable to lenders in a recession.

From job losses to economic factors like inflation, the number of borrowers who score below 680 rises - even when they scored above 700 at the time of origination. In two decades, we’ve accumulated data that indicates borrowers with FICO scores under 680 trigger a notable increase in VSI claims.

We all recognize that the economic landscape is shifting in a way that will increase loan defaults. Lenders can protect their collateral with solutions like VSI and other tools in Miniter Group’s expertise.

For a thorough history of VSI Insurance, please read Miniter’s Complete Guide to Vendor Single Interest Insurance (VSI)

Conclusion

Improve every aspect of your recovery process by outsourcing your GAP claims to the experts. Learn more about the services Miniter Group provides to improve your revenue and reduce your workload here.

Questions about compliance and regulations? Ask Us Anything! Drop us a line anytime and we’ll get back to you within 48 hours, no matter how detailed your question is.

Curious about our range of solutions for vendor single interest insurance? Take a look at these insightful articles:

Understanding VSI Insurance in a Recession