Introduction to Mortgage Impairment Insurance

Collateral and Operational risks can be catastrophic risks that are unpredictable. These include collateral being destroyed by a fire or flood, as well as a class-action lawsuit which finds the lender at fault for a loan servicing error. Due to the possibility of large losses, collateral and operational risks should be transferred using lender-placed insurance and mortgage impairment insurance policies.

Collateral Risk

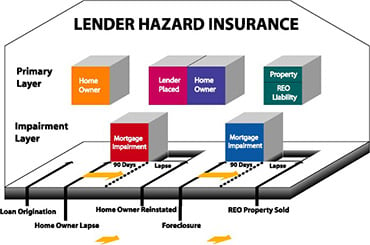

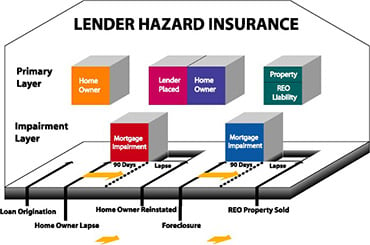

The lender’s mortgage is secured by a dwelling and/or real property. The promissory note requires the borrower to maintain insurance to protect the property. If the lender’s collateral risk is to be transferred, the lender’s interest in the property is best protected using the two-tier insurance coverage approach which includes the primary layer and the impairment layer.

Primary Layer

Coverage is supplied by the borrower in the form of homeowner's, commercial, or flood policy. The lender is named as the mortgagee on these policies. In addition to the borrower’s policy, there are dozens of lender-placed policies available in the marketplace to deliver primary layer insurance to the lender.

These policy options can lead to confusion by the lender.

Impairment Layer

Since lapses in the borrower’s coverage may occur due to cancellation or non-renewal of the borrower’s policy, the lender must have a second layer of insurance, called mortgage interest coverage, to protect the lender’s mortgage interest if physical damage occurs to the collateral property when the borrower’s insurance is not in effect.

The Primary Insurance Layer

This is the first layer of protection for both the lender and the borrower. The most important feature of the primary layer is that losses to a mortgaged property will be paid without the need for the lender to foreclose on the property. This enables the borrower to repair damage losses to the property and continue to fulfill his mortgage obligations. The primary layer has five types of insurance policies:

- Borrower Insurance

- Lender-Placed Insurance

- Blanket Mortgage Hazard Insurance

- Blanket 2nd & HELOC Mortgage Hazard Insurance

- REO Hazard and Liability Insurance

1. Borrower Insurance

The vast majority of homeowners in a mortgage portfolio will maintain homeowner’s primary layer insurance with the lender named as mortgagee. The minimum coverage required is defined by the lender in the promissory note. This coverage has dwelling and real property coverage as well as liability coverage. The lender is most interested in the property coverage since title to the property is in the borrower’s name and any liability claims would be brought against the titleholder.

2. Lender-Placed Insurance

The lender’s promissory note requires the borrower to maintain proper insurance which protects the lender’s interest. If the borrower fails to maintain this primary insurance, the lender will discover this through their insurance tracking system. A Lender-placed insurance policy will be placed that will protect both the borrowers and the lender’s real property interests.

The policy premium is billed to the borrower and is designed to protect the borrower and lender for physical damage losses up to the outstanding loan balance.

Liability coverage is not included because the lender has minimal liability risk as the borrower still maintains the title to the property.

Advantages of Lender-Placed Insurance

Both the borrower and the lender have real property coverage in the primary layer. The borrower is required to pay the lender-placed insurance policy premiums which reduce the lender’s operational expense.

Drawbacks of Lender-Placed Insurance

The lender has the expense to track all borrowers’ insurance policies to know when the coverage has lapsed or is insufficient.

3. Blanket Mortgage Hazard Insurance

This policy protects the lender’s entire mortgage portfolio for property damage and would be a substitute for Lender-Placed Insurance. When a loss occurs to a mortgaged property that is not covered by the borrower’s homeowner policy, the lender is protected up to the outstanding loan balance.

This coverage is typically used by community banks with a history of no lender-placed insurance primary layer losses. When this occurs the expense of the blanket premium paid for by the lender will approach the expense reduction of eliminating the tracking function.

Advantages of Blanket Mortage Hazard Insurance

The lender is not required to track the borrowers’ insurance policies and there is no chance for an insurance tracking error that may leave a property exposed.

4. Blanket 2nd & HELOC Mortgage Hazard Insurance

This policy protects the lender’s entire portfolio of 2nd mortgage, equity, and home equity line of credit (HELOC) loans and lines. When a loss occurs to a mortgaged property that is not covered by the borrower’s homeowner policy and exceeds the limit of liability of any primary layer insurance provided by the first mortgage lender, the lender is protected up to the outstanding loan balance.

The lender pays for this coverage annually and the premium is based on the size of the portfolio being insured. Since the mortgage in the first position maintains primary layer insurance as well, this coverage is typically less expensive than tracking the borrower’s insurance.

Advantages of Blanket 2nd & HELOC Insurance

The lender is not required to track the borrowers’ insurance policies and there is no chance for an insurance tracking error that may leave a property exposed.

Drawbacks Blanket 2nd & HELOC Insurance

The lender must pay the policy premiums, but the premium cost is typically less than the cost to track insurance on this type of portfolio.

5. REO Hazard and Liability Insurance

This policy protects the lender after a property is foreclosed and the lender has title to the property. This coverage has dwelling and real property coverage as well as liability coverage available by endorsement since the title is now in the lender’s name. This coverage is typically placed by the lender at foreclosure. The lender keeps this coverage in place until the property is sold. Coverage can be extended to REO properties from both the lender-placed insurance or the blanket mortgage hazard insurance policies.

Advantages of REO Hazard and Liability Insurance

The lender is insured for both physical damage and liability. Losses incurred by the policy will not affect the lender package insurance policy to covers the lender’s branch and operations facilities.

Drawbacks of REO Hazard and Liability Insurance

The lender must pay for this coverage. The lender may request a high loss deductible to lower this premium expense.

Impairment Layer

This secondary layer of insurance is in place in the event one of the primary insurance policies does not respond. Loss of mortgage interest coverage is provided under the Mortgage Impairment insurance policy. Mortgage policies are designed to protect the lender from losses to its Mortgage Interest as well as losses due to errors and omissions (E&Os) in mortgage origination and mortgage servicing operations.

Mortgage Interest Coverage

The Mortgage Interest coverage under a Mortgage Impairment insurance policy protects the mortgagee from loss of its mortgage interest due to the reduction in the value of the property that was used to collateralize the mortgage. The policies typically require the lender to:

- require that the borrower obtain insurance on the mortgaged property, and

- verify the existence of the required insurance at the time the mortgage is originated.

Additionally, if the lender becomes aware that the borrower’s insurance has lapsed, the Mortgage Interest coverage is limited to 90 days from the date that the lender received the notice of cancellation or non-renewal. This 90 day period is intended to allow the lender enough time to contact the borrower and obtain evidence of replacement insurance coverage.

If the borrower does not provide evidence of replacement coverage, the lender should obtain lender-placed coverage to protect their interest.

Insurance Tracking Techniques for Mortgage Impairment

The insurance tracking requirements of the Mortgage Impairment policy coverage can be written on a

- Checking,

- Ex-Checking,

- or Blanket basis (more on this later).

Checking Basis

This technique requires that the lender confirm annually that the borrower’s insurance is being maintained. Annual confirmation requires the lender to obtain either a copy of the renewal policy or an acceptable certificate of insurance, providing details of the coverage on the mortgaged property.

Miniter’s Outsource Insurance Tracking (OST) service is designed for mortgage impairment coverage that is written on a Checking basis. Additionally, some mortgage impairment insurers provide additional premium credits if the lender outsources insurance tracking to a third-party vendor (like Miniter).

Ex-checking Basis

This technique eliminates the requirement of annual homeowner verification, but still enables the lender to respond to cancellation and non-renewal notices as required by the Mortgage Impairment policy. Miniter Group’s Write-Your-Own insurance tracking (WYO) service is designed for lenders who choose ex-checking insurance tracking.

Mortgage Impairment Liability Coverage

Mortgage Impairment liability coverage is used as an E&O policy for the lender’s loan servicing department. This coverage applies to both portfolio and service-retained loans.

Third-Party Liability

Mortgage Impairment policies also contain a third-party liability component that protects the lender from lawsuits resulting from:

- Failure of the insured to purchase or maintain insurance for the benefit of the borrower.

- Failure to pay real estate taxes on behalf of the borrower.

- Failure to accurately determine whether a mortgaged property is located in a Special Flood Hazard Area.

- Failure to maintain FHA, VA or private mortgage insurance on the mortgaged property.

Secondary Mortgage

A large percentage of residential mortgages are sold by the originating lenders to secondary mortgage markets known as Government Sponsored Enterprises (GSEs). The lenders no longer own the mortgages but retain servicing rights for the mortgages.

Mortgage servicing for GSE loans typically involves:

- Accepting and disbursing the monthly mortgage payment.

- Escrowing and disbursing funds for insurance premiums and real estate taxes.

- Verifying the maintenance of the required insurance coverages.

- Foreclosing on properties on which payments become delinquent.

The Mortgage Impairment policy provides Errors & Omissions coverage for these GSE servicing activities.

Also, many of the FHA and VA mortgages are guaranteed by the General National Mortgage Association (Ginnie Mae). To assure that the interest of the mortgage owners (secondary markets) is protected; Ginnie Mae, Fannie Mae, and Freddie Mac all have mortgage servicing guidelines that require the FI to purchase the above-stated Mortgage Impairment coverage and for the policy to include the following coverage extensions:

- Coverage is extended to include the owner of the mortgage as well as the mortgage servicer.

- Loss payments are to be made payable jointly to the insured and the owner of the mortgage.

- The owner of the mortgage has a right to file a claim under the MI policy.

- The owner of the mortgage is to receive at least 30 days advance notice if the MI coverage is canceled, non-renewed or substantially restricted.

The requirements of the GSEs, relative to Mortgage E&O coverage, place a significant compliance burden on mortgage lenders. Not all insurers and brokers offer coverage that is compliant with these requirements. Only the most experienced brokers or underwriters understand the guidelines and have the ability to customize Mortgage Impairment coverage that is compliant with GSE guidelines.

Blanket Direct Physical Loss Coverage

There are Mortgage Impairment Policies now available that will eliminate both the 90-day coverage rule and the need to track primary insurance. These types of policies are cost-effective for smaller lenders with low risk that have little or no physical damage loss history. These types of policies should be compared with traditional Mortgage Impairment policies to determine the risk and cost-effectiveness of these policy types.

Summary

A properly underwritten Mortgage Impairment Insurance policy can be used:

- As a safety net for primary insurance.

- For E&O Coverage for loan servicing operations.

- For secondary market GSE compliance

Lender Collateral and Operational risks can and should be transferred by properly combining your primary and impairment layer strategy using both lender-placed and mortgage impairment policies.

Miniter Group’s Mortgage Impairment underwriters are some of the most experienced in the US market. Miniter Group underwrites Mortgage Impairment insurance for some of the largest lender’s in the country. At your next Mortgage Impairment policy renewal, let us help you improve your coverage as we have done for hundreds of lenders.

Would you like to be invited to our complimentary webinars? Subscribe here.